How to Partner with Chinese Injection Molding Companies

The important meeting has recently finished, your new product is a go, the schedule is tight, and the budget is… well, let’s just say it’s tight.. Then a voice—perhaps your manager or the CFO—drops the line that gives every project manager a shock: “We should look at sourcing this from China.”

Naturally, you agree. It makes sense on paper. The potential savings can be massive. However, your brain is racing with concerns. You’ve heard the stories, haven’t you? The nightmare of defective parts, opaque communication, and delayed, off-spec shipments. It’s like balancing on a tightrope between a massive cost advantage and project disaster.

Here’s the thing, though. Sourcing plastic mold company doesn’t have to be a gamble. It’s simply another project with clear steps. And as with any project, success depends on your methodology. It’s less about finding the absolute cheapest quote and more about finding the right partner and managing the process with your eyes wide open. Disregard those scary tales. Let’s walk through a real-world playbook for getting it right.

First Things First: Your Homework

Before you mention “supplier” or browse Alibaba, organize your internal data. Truthfully, over fifty percent of offshore sourcing issues originate in an unclear project brief. Don’t assume a remote factory can guess your needs. Sending a vague request is like asking a builder to quote you for “a house.” The responses you get will be all over the map, and none of them will be useful.

Your RFQ should be bulletproof—clear, detailed, and unambiguous. It’s the cornerstone of your entire effort.

So, what goes in it?

Begin with 3D CAD models. They’re essential. Provide files in common formats (e.g., STEP, IGS) to prevent import issues. This is the authoritative CAD geometry.

But 3D isn’t enough. Add comprehensive 2D plans. This is where you call out the stuff that a 3D model can’t communicate. Examples include tolerances (e.g., ‘25.00±0.05 mm’), material grade, surface finish requirements, and functional callouts. Any seal surfaces or critical hole sizes must be clearly labeled.

After that, material choice. Avoid generic terms like “Plastic.” Even “ABS” alone is too vague. Be explicit. Call out SABIC Cycolac MG38 (black), for example. Why? Because resin grades number in the thousands. Defining the exact material guarantees the performance and appearance you designed with what is plastic mold.

They can offer alternatives, but you must provide the initial spec.

Finally, include the business details. What’s your forecasted annual volume (EAU)? You must specify if it’s a 1K-part tool or a 1M-part production run. Tool style, cavity count, and unit cost are volume-driven.

The Great Supplier Hunt

Okay, your RFQ package is a work of art. who will you target? The web is vast but overwhelming. It’s easy to find a supplier; it’s hard to find a good one.

Your search will likely start on platforms like Alibaba or Made-in-China.com. These are great for casting a wide net and getting a feel for the landscape. Treat them as initial research tools, not final solutions. Aim for a preliminary list of 10–15 potential partners.

However, don’t end your search there. Perhaps hire a local sourcing specialist. Yes, they take a cut. Yet top agents deliver reliable, audited suppliers. They are your person on the ground, navigating the language and cultural barriers. For a first-time project, this can be an invaluable safety net. Think of it as insurance for your project timeline.

Another tactic: trade exhibitions. With budget permitting, Chinaplas or similar shows are invaluable. In-person meetings trump emails. Hold samples, talk shop, and gauge professionalism firsthand. And don’t forget the oldest trick in the book: referrals. Ask other project managers in your network. Peer endorsements carry huge weight.

Sorting the Contenders from the Pretenders

After firing off that RFQ to a broad pool, the quotes will start trickling in. Some will be shockingly low, others surprisingly high. Your task is to filter them down to 2–3 credible finalists.

How do you do that? It blends technical checks with intuition.

Begin with responsiveness. Is their turnaround swift and concise? Do they communicate effectively in English? The true litmus: are they raising smart queries? Top vendors will critique and inquire. Example: “Should we add draft here for better ejection?” or “Your tolerance may require extended CMM time—okay?” Consider that a big green light. You know they know their stuff. A supplier who just says “No problem” to everything is a walking red flag.

Then confirm their machinery specs. Ask for a list of their equipment. Seek samples or case studies of comparable projects. A small-gear shop won’t cut it for a big housing.

Next up: the factory audit. You can’t skip this. You would never hire a critical employee without an interview, so why would you send tens of thousands of dollars for a tool to a company you’ve never truly vetted? Either visit in person or engage a local audit service. They’ll send a local inspector to the factory for a day. They confirm legitimacy, audit ISO 9001, inspect equipment condition, and gauge the facility. It’s a tiny cost for huge peace of mind.

Transforming CAD into Real Parts

After picking your vendor, you’ve negotiated the price and payment terms—a common structure is 50% of the tooling cost upfront to begin work, and the final 50% after you approve the first samples. Now the real fun begins.

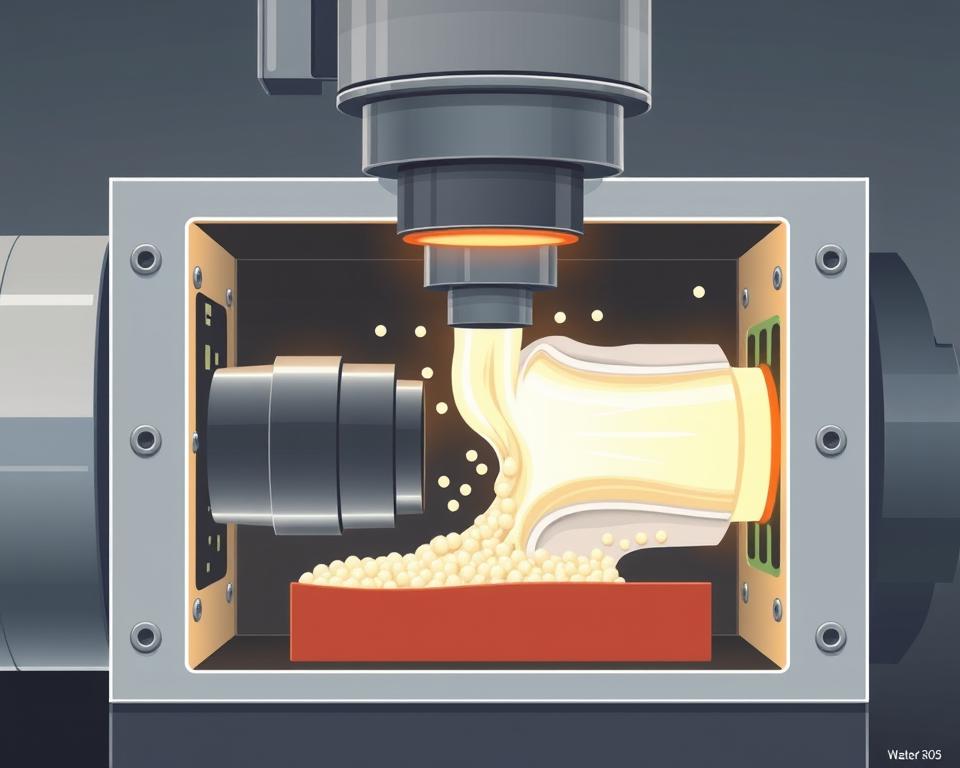

Your supplier’s first deliverable is a DFM analysis. DFM means Design for Manufacturability. It’s the engineering critique for moldability. It will highlight potential issues like areas with thick walls that could sink, sharp corners that could cause stress, or surfaces without enough draft angle for clean ejection from the mold. Comprehensive DFM equals a top-tier supplier. It becomes a joint effort. You work with their engineers to refine the design for optimal production.

When you greenlight the DFM, they machine the mold. Weeks on, you receive the thrilling “T1 samples shipped” notification. These are your initial mold shots. It’s your test of success.

T1 parts usually require adjustments. That’s standard process. There will be tiny imperfections, a dimension that’s slightly out of spec, or a blemish on the surface. You’ll provide detailed feedback, they’ll make small adjustments (or “tweaks”) to the tool, and then they’ll send you T2 plastic mold company samples. It could require several iterations. Build buffer time for sample iterations.

Eventually, you will receive a part that is perfect. It meets every dimension, the finish is flawless, and it functions exactly as intended. This is your golden sample. You sign off, and it serves as the master quality reference.

Crossing the Finish Line

Landing the golden sample is huge, yet the project continues. Now you’re entering the mass production phase. How do you maintain consistency for part 10,000?

You need a clear Quality Control plan. Often, you hire a pre-shipment inspection service. Use a third-party inspector again. They’ll randomly select parts, compare them to specs and golden sample, and deliver a detailed report. They’ll send you a detailed report with photos and measurements. Only after you approve this report do you authorize the shipment and send the final payment. This audit shields you from mass defects.

Finally, think about logistics. Understand the shipping terms, or Incoterms. Are you on FOB terms, where they load and you take over? Or is it EXW (Ex Works), where you are responsible for picking it up from their factory door? These choices hugely affect landed cost.

Sourcing from China is a marathon, not a sprint. It’s about building a relationship with your supplier. See them as collaborators, not vendors. Transparent dialogue, respect, and process discipline win. No question, it’s demanding. But with this roadmap, you can succeed, achieve savings, and maintain quality. You’re ready.